Introduction: The Quantum Leap in Technology and Investing

Quantum computing has shifted from theoretical physics to a rapidly evolving commercial technology poised to disrupt multiple industries. Companies like IonQ are at the forefront, developing hardware and software that exploit quantum mechanics to solve complex problems far beyond the reach of classical computers. For investors, the question looms large: can quantum computing stocks truly revolutionize portfolio returns, or is this sector another speculative bubble fueled by hype? This article explores the technological breakthroughs, market dynamics, health innovation applications, and investment considerations surrounding quantum computing stocks like IonQ.

Understanding Quantum Computing: Basics and Breakthroughs

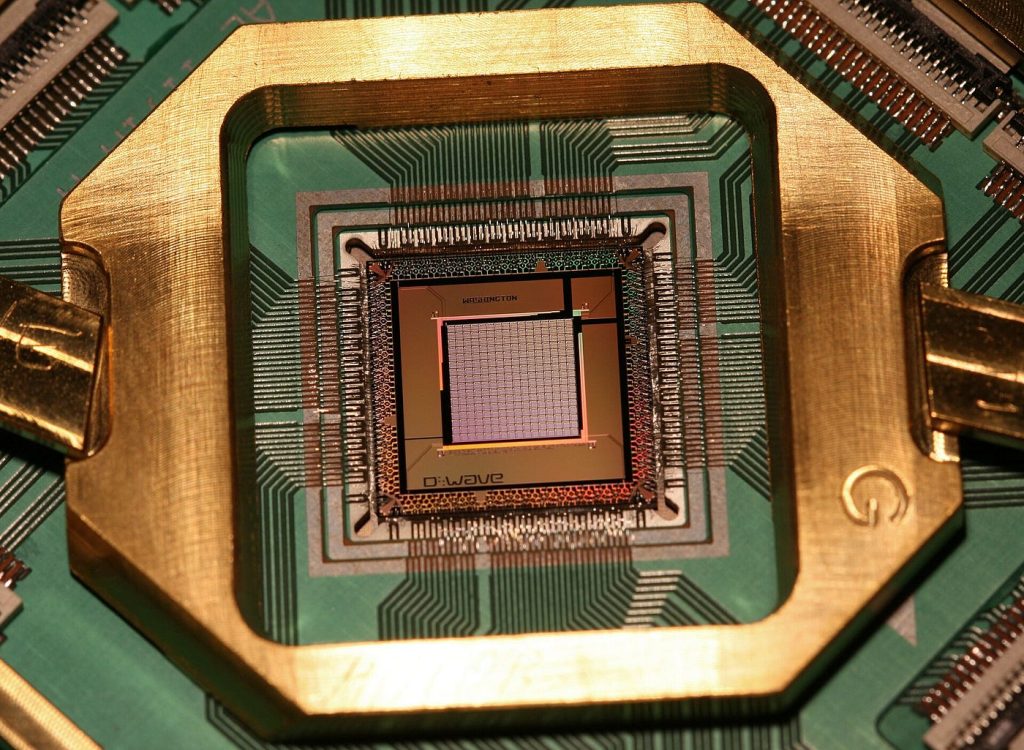

Quantum computing leverages principles such as superposition and entanglement to perform computations on qubits, enabling exponentially faster processing for certain problem classes. Unlike bits in classical computers, qubits can represent multiple states simultaneously, offering the potential to revolutionize cryptography, materials science, and drug discovery. IonQ, one of the leading pure-play quantum hardware providers, uses trapped ion technology to build scalable, high-fidelity quantum processors.

Recent breakthroughs in error correction, qubit coherence time, and system scalability have moved quantum computing from experimental labs into commercial pilot projects. IonQ’s cloud-accessible quantum processors represent a significant step toward practical quantum advantage—where quantum machines outperform classical counterparts in specific tasks.

Quantum Computing in Health Innovations: A Game Changer?

One of the most promising applications of quantum computing lies in healthcare and life sciences. The ability to simulate molecular interactions at an atomic level could transform drug discovery, protein folding analysis, and personalized medicine. Traditional supercomputers struggle with these highly complex calculations, which often require approximations.

Pharmaceutical companies and biotech startups are collaborating with quantum computing firms to accelerate the discovery of novel compounds, predict molecular behavior, and optimize clinical trial designs. IonQ has partnerships with healthcare-focused quantum software startups, providing early access to its processors for simulations that can cut research timelines dramatically.

Additionally, quantum-enhanced machine learning algorithms are being developed to analyze vast datasets from genomic sequencing and medical imaging, enabling faster and more accurate diagnoses. This intersection of quantum computing and healthcare promises not only better patient outcomes but also potential multi-billion-dollar market opportunities.

The Quantum Computing Market Landscape and IonQ’s Position

Quantum computing remains nascent, but market forecasts predict explosive growth. According to industry analysts, the global quantum computing market could reach $10 billion by 2030, driven by investments from governments, tech giants, and venture capital. Publicly traded pure-play companies like IonQ provide a unique window for retail and institutional investors to access this emerging technology.

IonQ went public via a SPAC merger in 2021, raising capital to expand its R&D and commercial partnerships. Its trapped-ion approach differentiates it from competitors relying on superconducting qubits or photonics. IonQ’s cloud services are gaining traction, with collaborations spanning Amazon Web Services, Microsoft Azure, and Google Cloud, enabling developers worldwide to experiment with quantum algorithms.

However, IonQ’s stock remains volatile. The company is still in the early revenue stages, burning cash on technological development. It faces stiff competition, including startups and established players like IBM, Google, and Rigetti, which have different technical approaches and funding levels. The question for investors is whether IonQ’s technological leadership and strategic partnerships will translate into long-term market dominance.

Risks and Challenges Facing Quantum Computing Stocks

Quantum computing investing carries substantial risks. The technology faces technical barriers: qubit error rates, system stability, and the need for robust quantum software ecosystems are still under development. Commercial viability depends on breakthroughs in these areas, which may take years or decades.

Market risks are amplified by hype cycles. Investors must differentiate between speculative excitement and genuine progress. Public quantum stocks have seen dramatic swings tied to technical announcements, government funding news, or competitor breakthroughs.

Regulatory and geopolitical factors also influence the space. Quantum computing’s potential to break current encryption standards raises security concerns and could trigger new policy frameworks affecting development and deployment. Intellectual property battles over quantum algorithms and hardware designs are intensifying.

For portfolio managers, balancing the high-risk, high-reward nature of quantum stocks with diversified exposure is crucial. Position sizing, timing, and fundamental analysis should guide decisions rather than FOMO-driven trades.

Case Studies: Quantum Computing Stocks’ Market Performance

IonQ’s journey since its SPAC listing illustrates the volatility inherent in quantum stocks. After an initial surge in late 2021, shares experienced sharp pullbacks amid broader tech sell-offs and skepticism about commercialization timelines. Nonetheless, strategic partnerships and quarterly progress reports have occasionally sparked rallies.

Other publicly traded quantum-related firms, such as Rigetti Computing (private but planning IPO) and Honeywell Quantum Solutions (now Quantinuum), show varying trajectories shaped by business models focused on hardware sales, cloud access, or software development.

Investor interest has also moved toward ETFs with quantum tech exposure, such as the Defiance Quantum ETF (QTUM), which combines established tech giants with emerging quantum players. These ETFs help mitigate individual stock volatility while capturing sector upside.

How Investors Can Approach Quantum Computing Stocks Today

Investing in quantum computing requires a forward-looking mindset with a tolerance for uncertainty. Here are key strategies for portfolio positioning:

- Diversify within the sector: Combining pure-play quantum hardware firms like IonQ with broader technology companies investing heavily in quantum R&D spreads risk.

- Focus on partnerships and commercial traction: Companies with active collaborations, growing cloud-based service revenues, or licensing deals demonstrate potential for near-term monetization.

- Evaluate technological differentiation: Understanding qubit type, error correction approaches, and roadmap realism is essential for assessing competitive advantage.

- Monitor regulatory and geopolitical developments: Quantum computing intersects with national security priorities and export controls, which can impact valuations.

- Use thematic ETFs cautiously: Quantum ETFs can reduce idiosyncratic risk but also include legacy tech stocks diluting pure quantum exposure.

- Consider long-term horizons: Quantum computing is a multiyear, possibly multidecade, investment theme; patience is key.

Conclusion: Revolutionizing Returns or Too Early to Tell?

Quantum computing stocks like IonQ represent a bold frontier at the intersection of cutting-edge technology and innovative healthcare applications. The sector holds promise to revolutionize problem-solving capabilities and open new avenues for medical breakthroughs, offering tantalizing investment upside.

Yet, the pathway to sustained profitability remains uncertain, technical challenges loom large, and market enthusiasm must be tempered with rigorous analysis. For sophisticated investors, selectively allocating a portion of their portfolio to quantum stocks could unlock outsized gains if the technology matures as envisioned.

In the end, quantum computing is not merely a stock pick but a bet on the future of computation itself. Whether IonQ and its peers will deliver revolutionary portfolio returns depends on their ability to translate scientific promise into scalable, profitable businesses amid a dynamic and evolving landscape.