Lessons from the Dot-Com Bubble and Today’s Tech Valuations

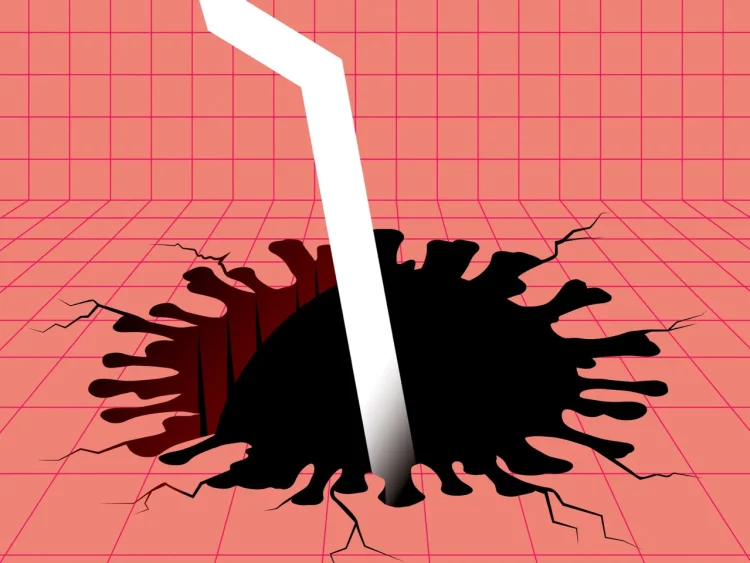

At the height of the dot-com mania in the late 1990s, markets were entranced by the promise of digital transformation. New companies with no profits—sometimes not even revenues—were valued in the billions simply because they had “.com” in their names. The Nasdaq surged more than 400% in just five years, peaking in March 2000 before plunging nearly 80% by late 2002. The crash wasn’t just about euphoria gone wrong; it was about a structural mispricing of future value, one that ignored fundamentals in favor of hype. The question for investors in 2025 is: are we repeating that pattern?

The comparison is not without merit. As of mid-2025, tech valuations have again reached elevated levels. Mega-cap stocks in AI, cloud computing, and semiconductors dominate market indices, and some are trading at price-to-sales ratios not seen since the early 2000s. Nvidia, for example, has become the poster child of AI-driven expectations, much like Cisco was during the internet boom. Meanwhile, profitless tech firms—particularly in the software-as-a-service and EV startup segments—continue to garner high multiples despite cash burn and competitive threats.

However, this time is different in some important ways. The leading tech companies today generate enormous free cash flow, have fortress-like balance sheets, and command dominant market positions globally. Apple, Microsoft, Alphabet, and Meta have real earnings and substantial moats. The bubble, if there is one, may be in the broader market’s overreliance on a narrow group of stocks, not necessarily in unjustified optimism across the board.

Another key difference is monetary policy. The dot-com crash happened in a world where the Federal Reserve had far more flexibility to ease aggressively. Today’s “higher-for-longer” rate environment means that any correction could be more drawn out, as liquidity support from central banks will be harder to come by. That alone changes the risk-reward dynamics of highly valued growth stocks.

Still, the echoes of past manias serve as a warning: sentiment can overshoot, and mean reversion is brutal. Valuation discipline matters, even in a world driven by tech.

Sentiment Indicators: What VIX and Put/Call Ratios Reveal

While valuations provide one part of the correction puzzle, investor sentiment offers another—often more immediate—clue. During the 2000 crash, exuberance was visible not only in prices but also in the behavior of retail investors and trading volumes. Today, the same dynamic is reflected in zero-day options trading, aggressive margin usage, and social media-fueled hype cycles.

The Volatility Index (VIX), often dubbed the “fear gauge,” remains historically low in 2025 despite a host of macro headwinds—from geopolitical shocks to inflation stickiness and interest rate uncertainty. This complacency may suggest a market underpricing risk, especially as earnings estimates stay elevated and breadth narrows.

More nuanced sentiment metrics like the put/call ratio show a rising tide of speculative bets. A declining put/call ratio typically signals growing risk appetite, as more traders buy calls (bullish bets) relative to puts (bearish hedges). When this ratio reaches extreme lows—especially during a rally—it can precede sharp corrections. Recent data in Q2 2025 shows this imbalance building, particularly in tech-heavy ETFs and single-name call options on AI and robotics stocks.

Investor surveys like AAII sentiment and fund flow reports also suggest overexposure to risk assets. Institutions have continued to overweight equities despite macro uncertainty, while retail flows into leveraged ETFs have surged again, echoing 2021-style enthusiasm. These behavioral signals, taken collectively, indicate that the market may be more vulnerable than pricing suggests.

While sentiment alone cannot time a crash, extreme optimism combined with stretched valuations and tight monetary policy creates a combustible mix. Smart investors should monitor these signals not to panic, but to adjust risk exposure proactively.

Defensive Sector Rotations: How to Prepare Without Overreacting

When markets correct, capital doesn’t disappear—it rotates. Historically, investors have moved from risk-on assets like tech and small caps into more defensive sectors such as utilities, consumer staples, and healthcare. These sectors tend to have stable earnings, pricing power, and less sensitivity to economic cycles.

In the 2000–2002 and 2008–2009 bear markets, utilities and consumer staples outperformed the broader indices by significant margins. In early 2022 during the brief correction triggered by Fed tightening, similar patterns emerged. Defensive stocks held ground or gained slightly while growth names tanked. The logic is simple: in uncertain times, investors seek predictability.

As 2025 unfolds, the sectors attracting rotation include healthcare (especially large-cap pharma and biotech with robust pipelines), food and beverage firms, and select industrials tied to national infrastructure projects. These are not high-growth plays, but they offer cash flow and durability—exactly what portfolios need when volatility returns.

Financials remain a wildcard. On one hand, rising rates support net interest margins for banks. On the other, concerns about credit quality, especially in commercial real estate and small business lending, have weighed on sentiment. Investors should stay selective within the sector, favoring strong regional players or diversified financials with low exposure to troubled loan segments.

Energy is another area worth watching. While cyclical in nature, energy stocks often outperform during inflationary or stagflationary episodes. Oil prices remain volatile due to geopolitical uncertainty, but integrated energy firms with dividend stability and low break-even costs offer a compelling value hedge.

Another useful rotation strategy is reducing exposure to highly levered firms. In a high-rate world, debt becomes more expensive, and refinancing risk increases. Companies with clean balance sheets, low capex needs, and recurring revenues are best positioned for resilience.

The Role of Macro and Policy Uncertainty in Corrections

While history doesn’t repeat exactly, it rhymes—especially when it comes to policy-driven risk. In 2000, the Fed’s tightening contributed to the bursting of the dot-com bubble. In 2008, a combination of regulatory failure and leverage implosion sparked the crisis. In 2020, it was a pandemic shock. Today, the risks are both economic and political.

2025 is shaping up to be a year of heightened geopolitical uncertainty. Tensions in the Taiwan Strait, Middle East energy dynamics, and rising economic nationalism all feed into supply chain instability and capital flow volatility. At the same time, major elections in the U.S., U.K., and parts of Europe could lead to sudden policy reversals—on tax, trade, and fiscal spending.

The Federal Reserve is walking a tightrope. While inflation has eased from its 2022 highs, services prices and wage growth remain sticky. Any sign that the Fed may need to hike further—or delay cuts into 2026—could rattle markets that are priced for a Goldilocks scenario. Conversely, if the Fed signals a readiness to pivot due to slowing growth, markets may rally briefly before repricing recession risk.

Investors should stress test portfolios across three scenarios: continued rate hikes, prolonged pause, and eventual cuts due to downturn. Each has different sector and asset class implications. A hike favors defensive sectors and short-duration fixed income. A pause with inflation could lift commodities and real assets. Cuts signal economic deterioration and could support gold, treasuries, and high-quality bonds.

Market Corrections as Strategic Opportunities

Corrections, while painful, are not the end of the world. In fact, they often present rare chances to accumulate quality assets at attractive prices. The key is to separate signal from noise and to remain disciplined in allocation.

Dollar-cost averaging into broad index funds, rebalancing into defensive sectors, and trimming speculative positions are prudent steps. Cash levels should be evaluated not as lost opportunity, but as dry powder for future entry points. Investors who stayed disciplined during past corrections—those who avoided panic selling and continued contributing—often emerged stronger.

Timing the bottom is nearly impossible. But being prepared for volatility, understanding sector dynamics, and leveraging historical insights make the difference between reactive losses and proactive gains.

Conclusion: Risk Is a Feature, Not a Bug

Historic corrections—from the dot-com bust to the Great Financial Crisis—teach us that markets are cyclical, sentiment is fickle, and discipline is rewarded. In 2025, the same dynamics are at play: elevated valuations, concentrated leadership, and macro headwinds require both caution and clarity.

Rather than fearing correction, investors should embrace the insight it brings. It reveals what’s real versus what’s hype. It exposes weak balance sheets and faulty assumptions. And most importantly, it resets expectations—creating fertile ground for sustainable returns.