Whoa! Okay, so check this out—I’ve been knee-deep in Solana tooling for years. My instinct said early on that validator choice mattered more than little UI niceties. But then I watched staking rewards wobble and realized I was underestimating network topology. Hmm… somethin’ about that felt off.

Short version: validator selection, protocol risk, and token custody are tightly coupled. Choose poorly and your yield vanishes or your funds get at risk. Seriously? Yes. The nuance is where most folks trip up. I’m biased, but custody choices matter a lot—especially when you plan to stake or use DeFi.

Here’s the practical lens. First, think decentralization. Second, measure the economics. Third, vet the ops. These are simple rules. Though actually, wait—let me rephrase that: those rules need context. On one hand, a small validator can be independent and friendly to the cluster. On the other hand, small validators might get slashed if they misbehave. It’s complicated. And yes, I’ve delegated to a node that went offline during a spike—learned the hard way.

Validator selection starts with basic signals. Short uptime. Good performance. Low commission. Medium stake concentration. Look at vote credits and delinquent epochs. Those are the immediate metrics. But don’t stop there. Dig into the team’s public presence. Do they publish contact info? Do they respond in Discord? If not, that’s a red flag. Oh, and by the way… check whether they run multiple identities under one operator. Centralized operators often masquerade as many validators.

Commission isn’t everything. Very very important: consider reward stability. A 2% commission with frequent downtime can be worse than a 7% commission with rock-solid uptime. Initially I thought low commission always wins, but then rewards and compounding taught me otherwise. There’s also the warm fuzzies—some validators donate a portion to community grants. I’m not 100% sure that matters for yield, but it speaks to incentives and culture.

DeFi Protocols on Solana — risk, reward, and how to think about them

DeFi on Solana moves fast. Really fast. That’s both exciting and scary. Protocols innovate aggressively. They also ship bugs. My gut says favor maturity over shiny APY. Yield is seductive. Don’t let that blur your judgement.

Start with these checks: audits, time-in-market, TVL trends, and upgradeability patterns. Audits are useful, though not foolproof. An audit can miss emergent economic attacks or oracle failures. On the other hand, no audit is a big red flag—especially for permissionless pools. Also track governance tokens and vesting schedules. Sudden unlocks can tank prices overnight.

Liquidity matters. Thin pools amplify slippage and impermanent loss. If you plan to provide liquidity for an SPL pair, simulate trades and imagine a 30% market move. If that blows you out, rethink the position. I’m not just theorizing here—I’ve walked out of a severely skewed pool after a repo token implosion. It hurt, but it taught me to stress-test assumptions.

Interoperability is another angle. Bridges, wrapped tokens, and cross-chain wrappers introduce attack surface. If a protocol relies on a single bridge, consider that an added risk multiplier. On the flip, well-architected composability can yield real benefits—efficient swaps, lower fees, and faster settlements—so don’t dismiss innovation either.

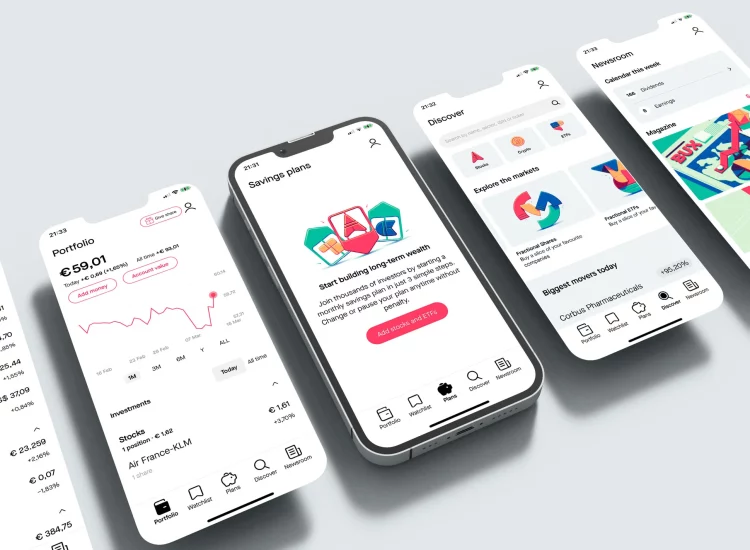

Use a reliable wallet to interact. If you’re in the Solana ecosystem, a practical wallet choice helps you manage keys, stake, and program approvals without pain. For a smooth staking and DeFi experience, try the solflare wallet—I’ve used it for delegations and governance interactions, and it balances usability with control. That link should get you to the wallet page and more details about setup.

Permissioning and approvals are often overlooked. When you click “approve” for a DeFi contract, you’re granting a program access to tokens. Approvals should be limited in scope and timeframe where possible. Many wallets let you revoke allowances; make it a habit to review them monthly. Seriously, this is a small step that prevents big headaches.

Quick FAQ

How do I pick a validator without being deeply technical?

Look for uptime >99%, moderate commission, transparent operator info, and reasonable stake size (not overwhelmingly large). Prefer validators that rotate rewards in public or publish infra notes. If you want extra safety, split your stake across multiple validators—diversify like an asset allocation, not a bet.

What should I watch for in DeFi contracts?

Audit status, recent code changes, and how funds are managed. Check whether the contract is upgradeable and who controls upgrades. Inspect the pool’s liquidity and the token vesting schedule. And simulate worst-case market moves to estimate loss exposure.

Any tips for managing SPL tokens securely?

Use a reputable wallet with clear signing prompts. Keep private keys and seed phrases offline. Use hardware wallets when moving large balances. Be cautious granting program approvals and revoke allowances when idle. And label accounts so you don’t accidentally send tokens to the wrong address—trust me, that bite stings.

Okay, one last candid thing. The ecosystem will keep changing. New validators will emerge. Protocols will pivot. My advice? Keep a watchlist. Reassess quarterly. Have a small experimental bucket for high-risk plays. The rest should be boring and steady. That balance kept my portfolio sane through a couple of ugly market episodes.

Final thought—this stuff is social as much as technical. Join community channels, read post-mortems, and ask tough questions. People who operate validators or DeFi protocols can be helpful or evasive—judge them by action. I’m on the skeptical side, but open to being surprised. Somethin’ tells me that’s the healthiest posture.