Introduction: Understanding Market Uncertainty and Its Impacts on Investment Strategy

The global financial landscape in 2025 is marked by uncertainty. The interplay of inflationary pressures, geopolitical tensions, fluctuating interest rates, and the aftershocks of the COVID-19 pandemic has created an unpredictable environment for investors. In times of market volatility and unpredictability, the importance of building a resilient portfolio cannot be overstated. Resilience in investing means creating a strategy that can weather market downturns, while still taking advantage of growth opportunities when conditions are favorable.

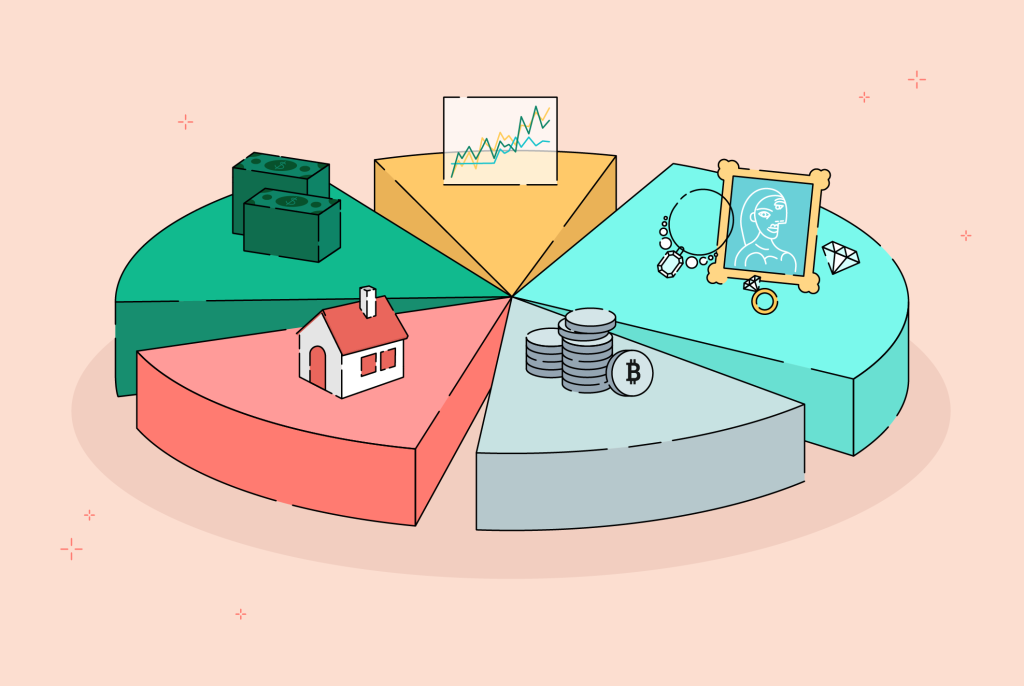

The key to navigating this uncertainty is diversification—spreading investments across various asset classes and sectors to reduce risk. In this article, we will explore how investors can build a resilient portfolio, using diversification techniques that provide protection against market volatility while positioning for long-term growth.

Diversification Techniques: A Cornerstone of Resilience

Diversification is a fundamental investment strategy that involves spreading investments across various assets, sectors, geographies, and investment vehicles. By doing so, investors reduce the risk that any one underperforming asset will significantly impact their overall portfolio. While diversification doesn’t guarantee immunity from losses, it greatly reduces the risk of major drawdowns and increases the chances of achieving stable, long-term returns.

1. Diversifying Across Asset Classes

One of the most effective ways to build a resilient portfolio is by investing across different asset classes. Stocks, bonds, real estate, commodities, and cash can all serve different functions in your portfolio, helping to reduce overall volatility.

- Equities: Equities, or stocks, represent ownership in a company and offer the potential for long-term growth. However, stocks are generally the most volatile asset class. By carefully selecting stocks with strong fundamentals, particularly those with a history of steady dividends and solid earnings growth, investors can balance the risks of equity investing. A key consideration is to invest in a diversified basket of stocks across sectors such as technology, healthcare, consumer staples, and energy, which tend to perform differently based on economic conditions.

- Bonds: Bonds provide stability and income. They are typically less volatile than stocks and tend to perform well when interest rates are falling. However, rising rates can negatively impact bond prices. A mix of government bonds, corporate bonds, and municipal bonds can help ensure that your portfolio remains resilient in a variety of market conditions.

- Real Estate: Real estate investment trusts (REITs) and direct property investments offer diversification benefits as they tend to move independently of stock and bond markets. Real estate has historically provided solid returns, with the added benefit of serving as a hedge against inflation. However, real estate investments can be illiquid, so it’s important to assess your need for liquidity before allocating a significant portion of your portfolio here.

- Commodities and Precious Metals: Commodities like gold, oil, and agricultural products often perform well during inflationary periods. Gold, in particular, is seen as a safe haven during times of economic uncertainty. Allocating a portion of your portfolio to precious metals or commodities can help hedge against inflation and market volatility.

- Cash: Holding cash or cash equivalents, such as money market funds, can provide liquidity and stability during market downturns. While cash doesn’t provide significant returns, it offers protection during times of crisis when other assets may be underperforming.

2. Geographic Diversification: Mitigating Regional Risk

Incorporating geographic diversification into your portfolio is another crucial technique to manage market uncertainty. Different regions and countries may experience different economic conditions at any given time. For example, while the U.S. may face economic stagnation, emerging markets such as India or Brazil might be experiencing growth. Conversely, while some European countries might be struggling with debt crises, others may see economic recovery and growth.

- Developed Markets: The U.S., Western Europe, and Japan represent developed markets with relatively stable economies. They are home to many large multinational corporations, which are generally well-equipped to weather market volatility. However, they are also more sensitive to global events, such as changes in trade policies or shifts in interest rates.

- Emerging Markets: Emerging markets, such as China, India, and parts of Southeast Asia, offer higher growth potential but come with increased risks. These markets are typically more volatile due to political instability, currency fluctuations, and underdeveloped regulatory frameworks. However, they can also provide high returns, especially in sectors like technology, consumer goods, and infrastructure.

- Developing Markets and Frontier Markets: These markets offer the highest risk but also the highest potential for returns. Investment in these regions should be approached with caution, focusing on long-term growth opportunities while accounting for political and economic instability.

3. Sector Diversification: Protecting Against Industry Cycles

Different sectors of the economy perform differently based on economic cycles, regulatory changes, and technological innovations. By diversifying across multiple sectors, investors can reduce their exposure to any one industry’s downturn. In times of economic recovery, certain sectors may outperform others, and in times of recession, the opposite may be true.

- Technology and Innovation: The technology sector has been a strong performer over the past decade, but it can be volatile. Investing in a variety of tech stocks, including large established companies and smaller innovative firms, can offer substantial long-term growth potential while mitigating risk. The rise of artificial intelligence, cloud computing, and renewable energy is expected to fuel growth in this sector.

- Healthcare: The healthcare sector has historically been resilient during market downturns because people will always need medical care. Biotech companies, pharmaceuticals, and healthcare equipment providers can perform well even in uncertain markets. The aging population in developed countries and advancements in medical technology provide strong tailwinds for this sector.

- Consumer Staples: Companies that produce essential goods like food, beverages, and household products are typically less affected by economic cycles. Consumer staples stocks tend to provide steady returns, making them a reliable part of a diversified portfolio. Additionally, these stocks often offer dividends, which can provide income during volatile times.

- Energy and Utilities: The energy sector, including oil, natural gas, and renewables, is closely tied to economic cycles and geopolitical events. While energy stocks can be volatile, they offer strong growth opportunities, particularly in the renewable energy space. Similarly, utility stocks tend to be stable, as consumers will continue to demand electricity and water regardless of economic conditions.

4. Alternative Investments: Balancing Risk and Reward

Alternative investments, such as hedge funds, private equity, and venture capital, offer another avenue for diversification. These investments often have a low correlation with traditional stocks and bonds, making them valuable tools for hedging risk. However, alternative investments tend to be more illiquid and can require a longer investment horizon.

- Hedge Funds: Hedge funds aim to generate positive returns in both bull and bear markets by employing strategies such as long/short equity, arbitrage, and derivatives. These funds tend to have higher fees but can offer substantial returns for investors who are willing to take on more risk.

- Private Equity and Venture Capital: These investments involve providing capital to private companies or startups, which can generate significant returns if successful. However, the risk of failure is higher, and liquidity is limited. For investors seeking to diversify their portfolios with high-risk, high-reward opportunities, these investments can be appealing.

5. Risk Management: Protecting the Portfolio During Times of Crisis

Building a resilient portfolio also involves incorporating risk management techniques that can protect against significant losses during times of market uncertainty.

- Rebalancing: Regularly rebalancing your portfolio ensures that it remains aligned with your investment goals. During times of market volatility, certain asset classes may become overrepresented, so it’s important to maintain the correct balance of stocks, bonds, and other assets.

- Stop-Loss Orders: A stop-loss order is a tool that allows you to set a predefined point at which your investments will automatically be sold to prevent further losses. This can help limit downside risk, especially in volatile markets.

- Hedging: Hedging involves using financial instruments such as options or inverse exchange-traded funds (ETFs) to offset potential losses in other parts of your portfolio. This can be especially useful during times of market instability, allowing you to maintain exposure to growth assets while reducing the overall risk.

Incorporating Recent Market News into Your Strategy

Recent news in 2025 underscores the importance of a diversified approach. The global economic landscape is characterized by fluctuating interest rates, supply chain disruptions, and geopolitical tensions. In response, many financial advisors are recommending that investors stay defensive by increasing their exposure to defensive sectors, such as utilities and healthcare, while reducing risk in cyclical sectors like consumer discretionary and industrials.

The U.S. Federal Reserve’s recent decision to raise interest rates again has had a profound impact on markets, pushing investors to reevaluate their portfolios. Rising rates can lead to a stronger dollar, higher borrowing costs, and slower economic growth. In light of this, incorporating more fixed-income assets, such as bonds, and increasing international exposure may help mitigate the risks associated with domestic rate hikes.

Conclusion: Building a Portfolio for Long-Term Success

In a world of increasing market uncertainty, diversification remains the cornerstone of a resilient investment strategy. By investing across different asset classes, sectors, and geographies, and incorporating risk management strategies, investors can better position themselves for long-term success. Staying informed and adjusting your portfolio in response to changing market conditions is essential for navigating these challenging times.