Introduction: The Inflation Puzzle in a Fragmented Global Economy

In the aftermath of the pandemic, inflation became the defining global economic story, sending shockwaves through households, businesses, and governments. What began as a synchronized surge in prices across the world has since evolved into a complex and uneven pattern. The sharp uptick in consumer prices in 2021 and 2022, driven by supply chain disruptions, energy shocks, and unprecedented fiscal stimulus, gave way to a more fragmented inflation picture by 2024. As we move through 2025, a critical question emerges: are global inflation trends converging again toward a common disinflationary path, or are they diverging in ways that challenge economic coordination, central bank policy, and investment strategy?

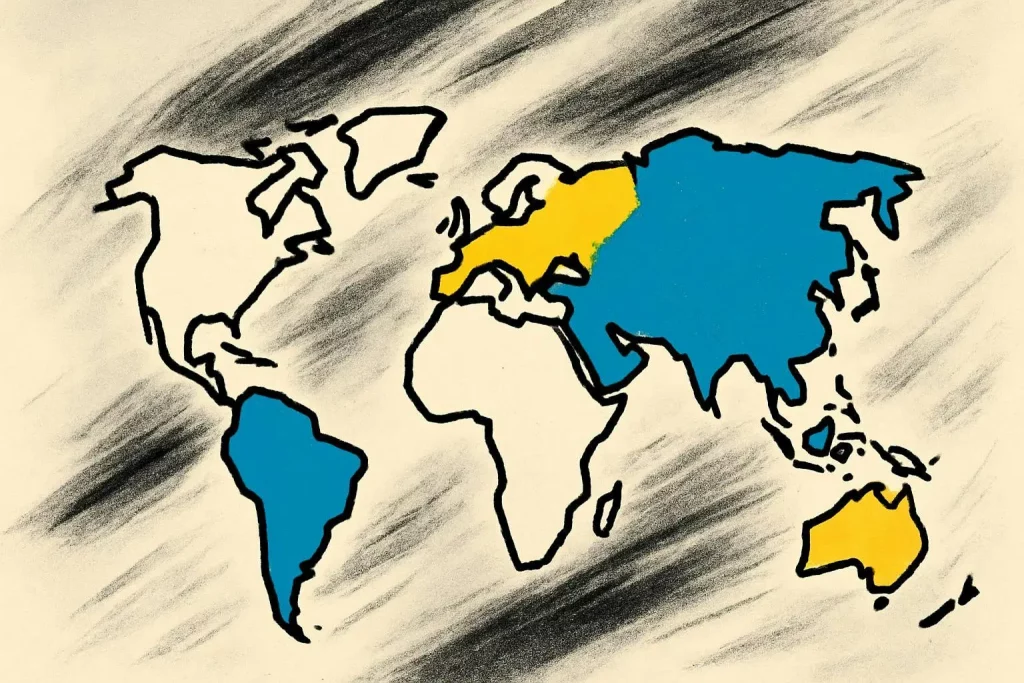

To answer this, we must examine inflation metrics in key economies—the United States, the European Union, the United Kingdom, and major emerging markets—while considering the diverging actions of their central banks. This analysis reveals a global economy wrestling with both shared and distinct inflationary forces, underscoring the increasingly regionalized nature of monetary policymaking and the implications for global investors navigating these fault lines.

United States: From Red-Hot Inflation to Bumpy Normalization

In 2021 and 2022, U.S. inflation surged to levels not seen in four decades, peaking at over 9% year-over-year in June 2022. The Federal Reserve responded with a historically aggressive tightening cycle, pushing the federal funds rate to levels above 5% by mid-2023. The central bank’s efforts began to bear fruit in 2024, with inflation declining steadily toward the 2–3% range. However, core services inflation—particularly housing, healthcare, and labor-intensive sectors—remained sticky.

Entering 2025, the inflation picture in the U.S. remains mixed. Headline CPI has cooled to around 2.7%, while core PCE, the Fed’s preferred measure, hovers near 2.4%. Goods deflation and easing energy prices have helped, but wage pressures and resilient consumer demand have kept services inflation elevated. A tight labor market, bolstered by demographic constraints and productivity gains, continues to complicate the Fed’s final steps toward its 2% target.

The Federal Reserve has adopted a cautious “higher-for-longer” stance, resisting calls to ease prematurely. Chair Jerome Powell has emphasized data dependency, underscoring that policy flexibility is essential in the face of crosscurrents such as geopolitical shocks, fiscal policy uncertainty, and evolving consumer behavior. As a result, U.S. inflation appears to be normalizing, but not in a straight line—and certainly not in sync with other major economies.

European Union: Disinflation Meets Structural Fragility

The eurozone’s inflation trajectory has followed a similar arc, but with notable regional disparities. Inflation in the EU soared in 2022 due to energy price spikes following Russia’s invasion of Ukraine. Some member states experienced double-digit inflation, particularly in Central and Eastern Europe, while Germany and France saw more moderate increases. The European Central Bank (ECB), initially hesitant to tighten, shifted gears in late 2022, eventually raising its policy rates above 4% and winding down its asset purchase programs.

By early 2025, eurozone headline inflation has fallen to around 2.3%, with core inflation slightly higher at 2.6%. However, the region’s disinflation is underpinned more by weakening demand than by improved supply conditions. Growth across the bloc remains anemic, with Italy and Germany flirting with recession, and industrial activity subdued. Unlike the U.S., wage growth in the eurozone has been muted, limiting the risk of a wage-price spiral but also stalling consumption.

The ECB faces a delicate balance: inflation has slowed, but so has growth. Policymakers are under pressure to pivot, but structural weaknesses—including low productivity, demographic headwinds, and fragmented fiscal policies—limit their room for maneuver. Divergent conditions across member states further complicate policy calibration. In this context, the EU’s inflation trend appears convergent with the U.S. on the surface but rests on a far more fragile economic foundation.

United Kingdom: Stubborn Inflation and a Hawkish Bank of England

Among advanced economies, the United Kingdom has faced one of the most persistent inflation challenges. Brexit-related labor shortages, trade frictions, and an energy crisis exacerbated by geopolitical tensions have kept UK inflation well above target. After peaking at over 11% in late 2022, inflation has declined more slowly than in the U.S. or EU. Core inflation has remained sticky, driven by wage growth and services prices.

As of early 2025, UK inflation remains around 3.5%, with the Bank of England (BoE) maintaining a cautious but hawkish stance. Interest rates have stabilized above 5%, with the central bank signaling that premature easing could reignite price pressures. Governor Andrew Bailey has emphasized the need to avoid entrenching high inflation expectations, particularly in wage negotiations and services sectors.

The UK economy faces additional risks: sluggish investment, high public debt, and an ongoing productivity malaise. Consumer spending has held up better than expected, but mainly due to credit and savings drawdowns, raising sustainability concerns. Unlike the U.S. and EU, the UK shows little sign of returning to the 2% inflation target anytime soon. Thus, the UK stands as a clear example of divergence in global inflation dynamics—one where structural and policy idiosyncrasies amplify inflation persistence.

Emerging Markets: A Tale of Two Realities

Inflation in emerging markets has evolved unevenly. Some, like Brazil and India, moved early and aggressively to combat inflation, reaping the benefits of declining price pressures and relatively stable currencies. Others, such as Turkey and Argentina, continue to battle runaway inflation driven by policy missteps, political instability, and currency depreciation.

Brazil, once a global inflation hotspot, now boasts one of the sharpest disinflation stories, with CPI near 4% after peaking above 10%. The Central Bank of Brazil began raising rates in early 2021, well ahead of the Fed or ECB, and is now cautiously cutting as inflation eases. India has managed inflation moderately, with headline CPI hovering around 5%, helped by food price controls and targeted subsidies. Its central bank remains vigilant, prioritizing inflation stability over aggressive stimulus.

In contrast, Turkey’s inflation remains above 40% despite recent central bank tightening, undermined by years of unorthodox policies. Argentina, mired in debt crises and currency controls, sees inflation exceeding 100%, with little prospect of stabilization absent major reforms.

Overall, emerging markets display the widest inflation divergence globally. While some have converged with advanced economies in price stability, others remain trapped in spirals of volatility and policy dysfunction. This divergence underscores the importance of governance, central bank independence, and fiscal discipline in determining inflation outcomes.

Central Bank Divergence: A New Era of Policy Decoupling

The post-2022 monetary landscape is marked by increasing central bank divergence. During the pandemic, global central banks moved in concert—cutting rates, launching asset purchases, and extending liquidity. Today, their paths diverge sharply. The Federal Reserve remains restrictive but is closer to pausing. The ECB faces pressure to support growth. The Bank of England continues to fight sticky inflation. Emerging market central banks are either easing or staying cautious based on local dynamics.

This policy divergence reflects not only varying inflation paths but also differing institutional mandates, political contexts, and external vulnerabilities. It has led to greater currency volatility, changes in capital flows, and divergent bond market performances. For global investors, this fragmentation challenges the traditional correlations between risk assets and inflation hedges.

Furthermore, central bank credibility has become a differentiating factor. Markets now reward countries with consistent, data-driven monetary strategies and punish those perceived as erratic or politically influenced. This reputational divergence adds a qualitative dimension to global inflation analysis, affecting capital costs, investment returns, and geopolitical risk pricing.

Investment Implications: Navigating the Inflation Crosscurrents

For investors, the convergence or divergence of global inflation trends has critical implications. First, it affects interest rate differentials and currency strategies. A widening gap between Fed and ECB policy rates, for instance, can drive capital flows into dollar assets, strengthening the greenback. Diverging inflation trajectories also shape bond yield curves, affecting duration strategies and inflation-linked securities.

Second, inflation volatility reshapes equity sector preferences. In the U.S., disinflation favors technology and consumer discretionary stocks, while in the UK, persistent inflation benefits energy and defensive sectors. In emerging markets, stable inflation rewards countries with strong macro fundamentals and punishes those with policy risk.

Third, commodities remain a wildcard. While global demand has softened, supply constraints and geopolitical tensions continue to support prices in certain areas. Gold and other inflation-sensitive assets may retain value in portfolios as hedges against persistent price instability in select regions.

Fourth, asset allocators must grapple with increased correlation breakdowns. The era of synchronized policy and economic cycles is over, requiring more region-specific analysis and tactical flexibility. Global diversification remains essential, but blanket exposure is insufficient. Active management and selective hedging have become more valuable in navigating the inflation puzzle.

Conclusion: One Global Economy, Many Inflation Stories

As of 2025, global inflation is no longer a synchronized phenomenon. While headline inflation has eased across many regions, the underlying drivers, policy responses, and economic consequences vary widely. The United States appears on a path of controlled disinflation amid resilient growth. The eurozone treads cautiously in a fragile recovery. The UK grapples with stubborn inflation and structural headwinds. Emerging markets offer both stability stories and cautionary tales.

This divergence is not merely cyclical—it reflects deeper structural shifts in demographics, supply chains, labor markets, and geopolitical dynamics. For policymakers, coordination is more difficult. For investors, the inflation environment is more complex and fragmented.

The era of simple inflation narratives is over. We are entering a multipolar world of price dynamics, where convergence and divergence coexist. Success in this landscape requires discerning the signals from the noise, avoiding overgeneralization, and adapting strategies to a new and variegated inflation regime. Global inflation trends may eventually reconverge—but in 2025, they are unmistakably breaking apart.