In the ever-evolving world of financial markets, few metrics command as much attention as GDP growth. As the most comprehensive measure of a nation’s economic health, GDP growth projections serve as a foundational guide for investors seeking to allocate capital wisely. These projections influence everything from central bank policy to consumer confidence and corporate earnings forecasts. In 2025, with geopolitical uncertainty, supply chain realignments, and the persistent tug-of-war between inflation and interest rates, understanding the nuanced implications of GDP forecasts has never been more critical. Investors who can effectively interpret macroeconomic trends and align their strategies accordingly are likely to emerge as winners in this dynamic market environment

Global GDP Outlook for 2025 and Beyond

As we enter the second half of the 2020s, leading economists and institutions such as the International Monetary Fund (IMF), World Bank, and OECD have issued updated GDP growth forecasts reflecting current global dynamics. The IMF’s April 2025 World Economic Outlook projects global GDP growth at 3.2% for the year, a modest uptick from 2024’s 2.9%. The U.S. is expected to grow by 2.1%, supported by resilient consumer spending, a rebound in manufacturing, and sustained investment in energy transition infrastructure. In the Eurozone, growth is forecasted at 1.4%, hindered by labor market rigidities and a cautious monetary stance from the European Central Bank. Emerging markets like India and Brazil are poised to grow at 6.5% and 3.8%, respectively, reflecting the shifting center of gravity in global economic momentum

China, once the undisputed engine of global growth, is expected to expand by 4.8%, a tempered outlook shaped by structural reforms, demographic headwinds, and property sector deleveraging. Notably, ASEAN economies are projected to perform well, averaging 5.0% growth, driven by digital transformation and regional trade pacts like the RCEP. These regional differentials in GDP growth are not just academic—they shape capital flows, currency trends, and sectoral investment priorities. Investors must consider both global and country-specific growth trends when determining portfolio exposure

GDP as a Predictor of Market Performance

GDP growth does not always correlate directly with stock market returns, especially in the short term. However, over longer investment horizons, countries with higher and more stable GDP growth tend to produce superior equity returns. This is primarily because GDP growth supports earnings expansion, improves consumer and business confidence, and fosters an environment conducive to risk-taking. That said, the equity markets often price in future expectations well in advance. In 2025, with forward-looking indicators such as PMI readings and consumer sentiment surveys painting a cautiously optimistic picture, equities in countries with strong GDP outlooks—like India, the U.S., and Indonesia—are expected to outperform

Sectors tied to domestic consumption—such as retail, financials, and housing—typically benefit more from higher GDP growth than defensive sectors like utilities or healthcare. Moreover, small and mid-cap companies, which are more reliant on local economic conditions, tend to show greater sensitivity to GDP swings than their large-cap, globally diversified peers. This understanding can help investors refine their sector and size allocations within a given geography

Strategic Sector Allocation Based on GDP Trends

The most actionable insight from GDP forecasts lies in sector-specific investment strategies. When GDP growth is accelerating, cyclical sectors tend to outperform. These include industrials, consumer discretionary, financials, and information technology. In the U.S., for example, projected GDP growth above 2% suggests strong tailwinds for construction materials, fintech, AI-driven logistics, and travel services. In emerging markets, robust GDP growth supports infrastructure, green energy, and digital banking. India’s 6.5% forecast, for instance, reinforces the long-term bullish case for its real estate, IT services, and rural consumption sectors

In Europe, even with modest GDP growth, sectors aligned with EU policy initiatives—like renewable energy, automation, and semiconductors—offer above-market potential. Chinese equity investors, grappling with slower GDP growth, are pivoting toward healthcare innovation, robotics, and consumer staples as the economy transitions to a more sustainable, consumption-led model. Latin America’s improving macro backdrop points to opportunity in commodities, agribusiness, and telecom infrastructure, especially as local governments increase spending on connectivity and education

Fixed Income and GDP: Balancing Growth with Yield

For bond investors, GDP projections are vital for estimating the trajectory of interest rates and inflation. A higher-than-expected GDP number often stokes fears of inflation, prompting central banks to tighten monetary policy and pushing bond yields higher. Conversely, weak GDP figures can trigger rate cuts and drive bond prices up. In 2025, with growth stabilizing across major economies, central banks are expected to maintain a cautious stance, keeping real yields in focus. The U.S. Federal Reserve, for instance, is likely to hold rates steady in the near term while closely monitoring employment and GDP trends

This environment favors duration-sensitive assets such as long-dated Treasuries and investment-grade corporate bonds in economies with strong fiscal discipline. Emerging market sovereign bonds also become more attractive as GDP growth supports local currencies and improves creditworthiness. However, investors must tread carefully in countries with twin deficits or political instability, even if their GDP projections appear optimistic on paper

Commodities, Currency, and Real Assets

Beyond equities and fixed income, GDP trends influence commodities, currencies, and real assets. Strong GDP growth in resource-heavy nations such as Australia, Canada, and Brazil typically lifts commodity demand and supports mining and agriculture-linked assets. In 2025, copper, lithium, and rare earth elements remain in focus due to global electrification trends, which are further buoyed by solid GDP growth in infrastructure-heavy nations. Real estate investment trusts (REITs) also stand to gain in high-GDP regions, especially in logistics, warehousing, and multi-family housing

Currency markets respond strongly to relative GDP performance. Investors should expect strength in currencies tied to growth economies—like the Indian Rupee, Mexican Peso, and U.S. Dollar—while the Yen and Euro could underperform unless GDP growth surprises to the upside. Currency-hedged ETFs or FX strategies can help mitigate volatility when investing internationally

Aligning Portfolio Strategy with Economic Cycles

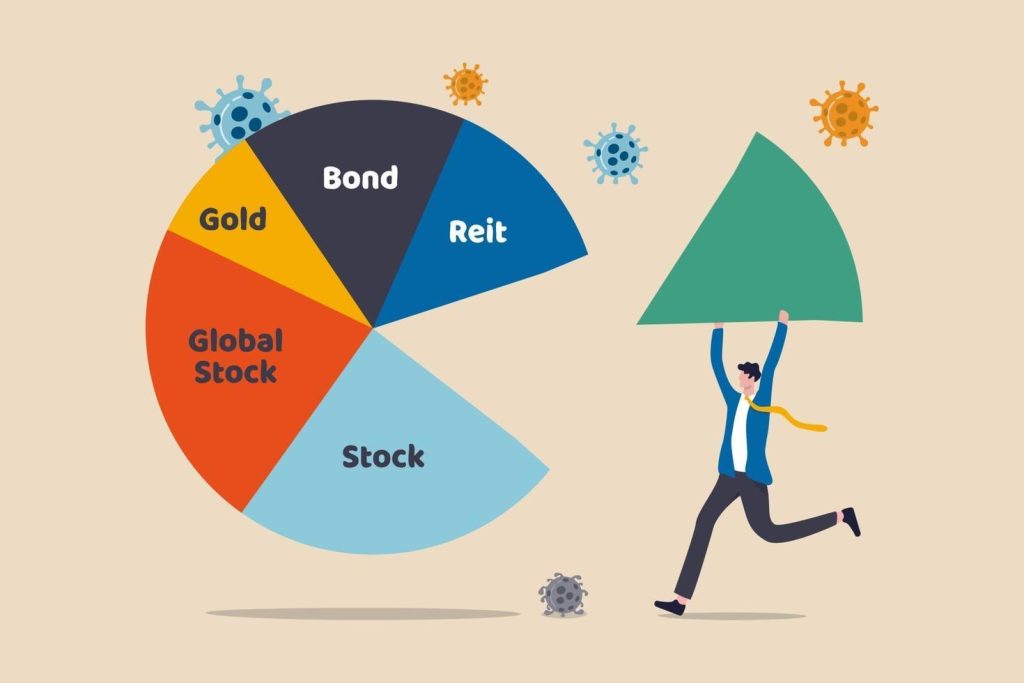

To effectively align investment strategies with GDP growth forecasts, investors must first determine their risk appetite and investment horizon. For growth-oriented investors, allocating capital toward cyclical and high-beta sectors in high-GDP economies may offer superior returns. For income-focused or conservative investors, a blend of dividend-paying equities, sovereign bonds, and real assets in regions with predictable GDP trends provides stability and consistent income. Tactical asset allocation—adjusting sector and geographic exposures based on updated GDP data—can enhance returns while managing risk

Additionally, investors should integrate GDP forecasts with other macro indicators such as inflation, unemployment, interest rates, and geopolitical developments. For example, strong GDP growth accompanied by high inflation may erode real returns, while modest GDP growth with falling inflation could enhance purchasing power and market sentiment. Multi-factor models that blend GDP projections with sector momentum, valuation metrics, and earnings growth can provide a more nuanced investment framework

Risks and Caveats

While GDP forecasts provide a useful macro compass, they are not infallible. Revisions are common, especially during times of geopolitical upheaval or policy transitions. For instance, unexpected events like trade wars, natural disasters, or pandemics can dramatically alter the GDP trajectory. Moreover, the relationship between GDP and asset prices is not always linear or immediate. Markets can rally on weak GDP if they expect aggressive stimulus, and they can sell off on strong GDP if it triggers hawkish central bank action. Hence, investors should treat GDP forecasts as one input among many and always stress-test their assumptions against adverse scenarios

Conclusion: Positioning for the Growth Frontier

In 2025, as economic engines shift and the global growth narrative becomes more fragmented, GDP forecasts are an indispensable tool for strategic asset allocation. Whether you’re targeting growth in Southeast Asia, stability in the U.S., or value in Europe, understanding where the GDP momentum lies is the first step. By combining macroeconomic foresight with agile portfolio construction, investors can navigate the complexities of the modern market with greater confidence. The key is not just to follow growth—but to anticipate where it leads next