Introduction: A Growing Storm Few Are Discussing

As equity markets flirt with new highs and economic data sends mixed signals, an often-underestimated threat is quietly building beneath the surface—soaring global debt. Across advanced economies and emerging markets alike, debt levels have exploded over the past decade, exacerbated by pandemic stimulus, rising interest rates, and persistent fiscal deficits. While the stock market has largely shrugged off these concerns so far, mounting debt burdens could be the catalyst for a significant reset in valuations and investor sentiment. Understanding how global debt interplays with broader market dynamics is essential for positioning portfolios defensively and opportunistically as 2025 unfolds.

The Scale of the Global Debt Problem

According to the Institute of International Finance (IIF), total global debt surged to over $315 trillion by early 2025, equating to roughly 340% of global GDP—a record high. Both public and private sectors have contributed to the surge. Governments expanded deficits to fund pandemic responses and infrastructure spending, corporations leveraged cheap money to finance buybacks and acquisitions, and consumers tapped credit lines to maintain lifestyles amid inflationary pressures. The U.S. federal debt alone surpassed $34 trillion, while debt in China’s corporate sector remains alarmingly high. Emerging markets, too, have layered on external debt, leaving them vulnerable to currency shocks. The sheer size and breadth of indebtedness mean that systemic risks are no longer theoretical—they are embedded in the global financial system.

Economic Indicators Flashing Warning Signs

Several key indicators suggest that the global debt load is becoming unsustainable. Debt service ratios—the percentage of income used to pay off debt—have risen sharply in both household and corporate sectors, particularly as interest rates climb. Sovereign bond spreads in emerging markets have widened, indicating growing default risks. Credit default swap (CDS) prices are trending higher for several major sovereigns and large corporates, signaling that investors are beginning to demand insurance against potential defaults. Central banks’ balance sheets, once tools for monetary policy, are now swollen to unprecedented levels, limiting their flexibility in the next crisis. Meanwhile, global liquidity indicators, such as cross-border bank lending and capital flows, show signs of tightening, raising the risk of a credit crunch.

How Debt Distorts Stock Market Valuations

Debt-fueled liquidity has been one of the major drivers behind the stock market’s impressive rally over the past 15 years. Ultra-low interest rates made risk assets the only game in town, pushing equity valuations to historic extremes. Price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and enterprise value-to-EBITDA multiples in sectors like tech have often defied traditional valuation models. However, as the cost of debt rises and liquidity contracts, these inflated valuations become vulnerable. Highly leveraged companies, particularly in sectors like real estate, consumer discretionary, and non-profitable tech, face margin compression, refinancing challenges, or outright solvency risks. When debt levels are high, even a modest increase in interest rates can have an outsized impact on corporate profitability and market stability.

U.S. Debt Dynamics: A Ticking Time Bomb?

In the U.S., the Treasury’s borrowing needs are staggering. The Congressional Budget Office (CBO) projects trillion-dollar annual deficits for the foreseeable future, driven by entitlement spending, interest payments, and defense budgets. As a result, the U.S. government must issue record levels of new debt just to roll over existing obligations and fund operations. Yet appetite for U.S. Treasuries is waning. Foreign holdings of Treasuries have declined as countries like China diversify away from dollar assets. Domestically, the Federal Reserve’s shift to quantitative tightening (QT) means that it is no longer a backstop buyer. Consequently, yields have risen sharply, increasing the government’s cost of borrowing in a vicious cycle. If investors begin to seriously doubt America’s fiscal sustainability, the impact could be profound—not only for bond markets but also for equities, which have long benefited from the perception of U.S. financial stability.

Global Implications: Fragility Beyond Borders

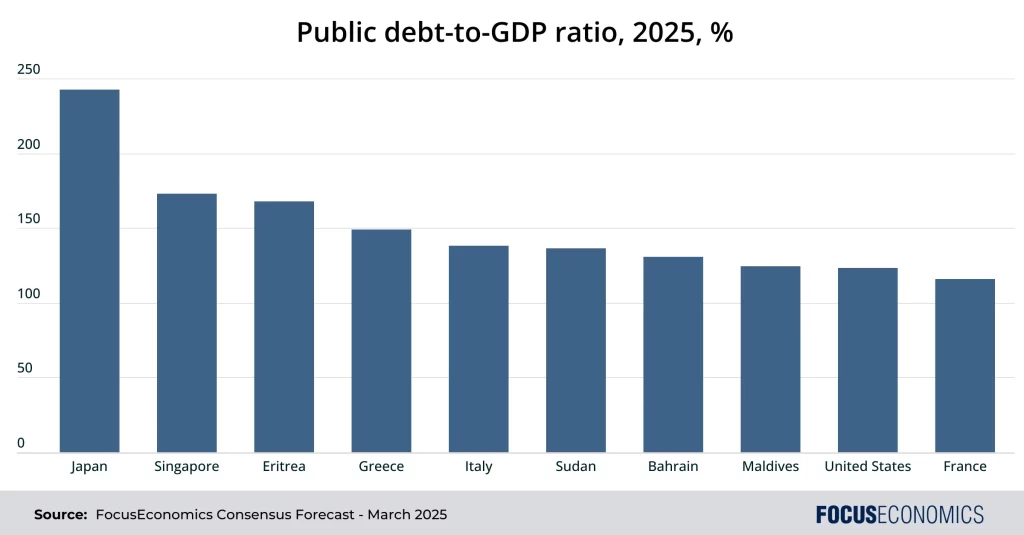

The debt crisis is not confined to the United States. In Europe, sovereign debt in countries like Italy, Spain, and France has ballooned, testing the limits of EU fiscal rules and the European Central Bank’s credibility. Japan continues to operate under a unique set of monetary dynamics, but its public debt-to-GDP ratio remains over 250%, an unsustainable figure in most scenarios. Emerging markets face the sharpest risks. Rising global interest rates and a stronger dollar have made debt servicing more expensive, prompting fears of a new wave of defaults reminiscent of the 1980s debt crisis. Countries reliant on commodity exports face double jeopardy: lower commodity prices and tighter financial conditions. Capital flight from emerging markets could accelerate if risk sentiment deteriorates, creating a feedback loop that impacts global growth and asset prices.

Debt and the Risk of a Financial Contagion

One of the most dangerous aspects of a global debt build-up is the potential for contagion. In highly interconnected financial markets, a crisis in one region or sector can rapidly spread across borders. For instance, a default by a major emerging market sovereign could lead to losses at international banks, prompt a selloff in emerging market ETFs, and trigger risk aversion that spills into developed markets. Likewise, stress in the U.S. Treasury market—the world’s most important collateral pool—could freeze global credit markets, similar to what happened during the 2008 financial crisis. Investors must recognize that systemic risks are not linear; they are exponential and can metastasize quickly under stress.

What Could Trigger the Debt Reset?

Several plausible scenarios could act as triggers for a stock market reset driven by debt concerns. A sharp spike in real interest rates could lead to widespread refinancing failures. A sovereign debt crisis in a major economy, such as Italy or Japan, could shake confidence in fiat currencies and government bonds. Political dysfunction—such as a U.S. debt ceiling impasse or a European fiscal crisis—could exacerbate market fears. A global recession could expose the weakest debtors and unleash a wave of defaults. Even a gradual erosion of confidence, without a specific flashpoint, could lead to a slow-motion correction as liquidity evaporates and risk appetite fades.

How Investors Are Preparing for the Debt Reckoning

Smart investors are already adjusting portfolios to account for heightened debt risks. Many are reducing exposure to high-beta, high-debt equities and rotating into quality stocks with strong balance sheets and durable cash flows. Fixed income allocations are shifting toward shorter-duration, high-quality bonds rather than long-dated sovereign debt. Gold and other real assets are being reconsidered as stores of value in a potentially unstable monetary environment. Some hedge funds are positioning for volatility spikes using options strategies. Geographic diversification is also a theme, as investors seek to hedge against region-specific debt crises. Above all, liquidity—having cash or cash equivalents readily available—is becoming prized once again as a strategic asset.

Can Central Banks Save the Day Again?

A key question is whether central banks, particularly the Federal Reserve and the ECB, could step in to avert a debt-driven market collapse. While central banks have shown remarkable willingness to intervene in past crises, their credibility and policy space are now more constrained. Inflation remains above target in many economies, limiting the ability to slash rates aggressively or restart large-scale asset purchases without risking further inflation surges. Political backlash against “bailouts” is also more intense than in previous cycles. While targeted interventions are likely if a full-blown crisis emerges, investors should not assume that monetary authorities can or will always be able to “save the market” without consequence.

A New Playbook for Investors

In this new era of debt awareness, the traditional “buy the dip” mentality must be tempered with greater caution. Risk management, balance sheet scrutiny, and macroeconomic vigilance are critical. Strategies that worked in an era of cheap debt and abundant liquidity—such as chasing speculative growth stocks—may underperform. Instead, investors may need to prioritize income generation, capital preservation, and tactical flexibility. Volatility is not an anomaly in this environment; it is a feature. Those who adapt to the realities of a debt-laden world can still find opportunities, but they must do so with clear eyes and disciplined strategies.

Conclusion: Debt as Destiny

Global debt levels have quietly risen to become one of the most serious systemic risks facing markets today. While the precise timing of a debt-driven reset is uncertain, the pressures are building, and the warning signs are becoming harder to ignore. Investors who recognize the profound implications of unsustainable debt burdens—and who adjust their strategies accordingly—will be better positioned to navigate the turbulence ahead. In the end, debt may not just be an economic statistic; it may be destiny for the markets in the years to come.