In the ever-evolving tech industry, Microsoft has emerged as one of the leaders in the AI space, particularly with its strategic investments in artificial intelligence (AI) technologies, including its partnership with OpenAI and its integration of AI tools across its product suite. As a result, Microsoft’s stock price has surged, prompting investors to question whether the company’s current valuation premium is justified or if it is simply riding the coattails of an AI hype cycle. This article takes a deep dive into Microsoft’s AI-driven revenue streams, its forward price-to-earnings (P/E) ratio, and the overall investment rationale that underpins its market premium.

The AI Renaissance: Microsoft’s Strategic Position

Artificial intelligence is often hailed as the next frontier in technological advancement, and Microsoft has strategically positioned itself at the forefront of this revolution. Through its 2019 acquisition of GitHub, its 2020 investment in OpenAI, and its cloud infrastructure, Microsoft has built a formidable AI ecosystem. The company is integrating AI across its software products, including Office 365, Azure, and its enterprise solutions, which has prompted investors to expect substantial future growth driven by AI-driven innovations.

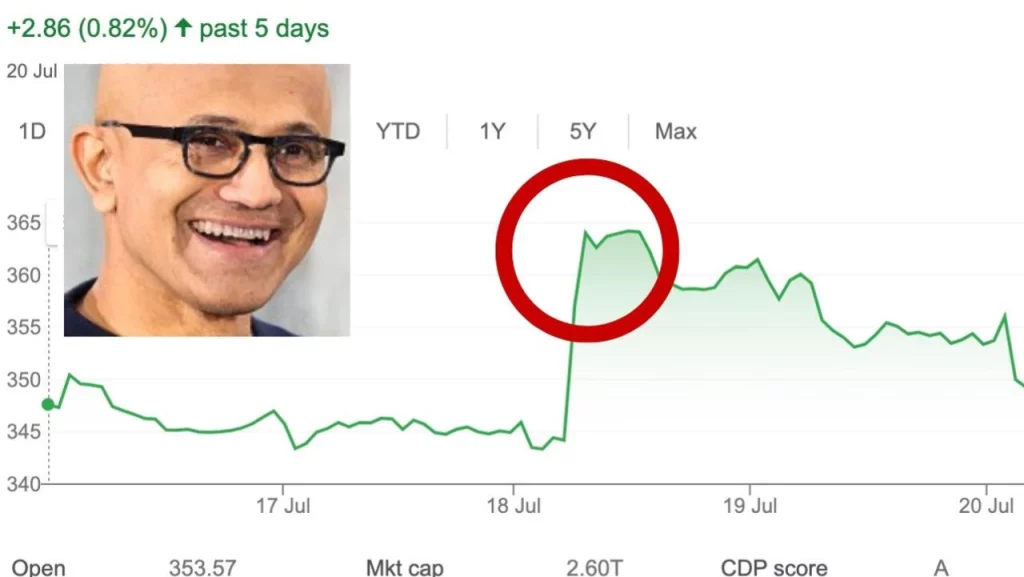

The rise of AI has sparked intense investor enthusiasm, pushing tech stocks, including Microsoft, to new heights. However, this optimism has raised important questions regarding valuation. With Microsoft’s current price-to-earnings (P/E) ratio sitting well above its historical averages, it is essential to assess whether the company’s AI initiatives will deliver the expected returns to justify its premium price.

AI as a Revenue Driver: How Much is Microsoft Earning?

Microsoft’s AI initiatives are not just a vague promise for future growth—they are already contributing to the company’s bottom line in significant ways. While the exact breakdown of AI-related revenue is not publicly disclosed, we can estimate its impact based on various business segments that benefit from AI adoption.

- Azure Cloud and AI Integration

One of Microsoft’s primary revenue drivers is its Azure cloud platform. The cloud business has already been a major source of revenue for the company, and the integration of AI capabilities into Azure has only bolstered its potential. Azure’s AI offerings are being adopted across industries, from healthcare to finance, as companies seek to leverage cloud computing and machine learning to enhance operations. Microsoft’s deep integration of AI into Azure has made it a key competitor to Amazon Web Services (AWS) and Google Cloud.

As of Q1 2025, Azure’s revenue growth continues to outpace other cloud providers, and AI adoption is expected to accelerate that trend. The growing demand for AI-powered cloud services has led to increased enterprise spending, with estimates showing that Azure’s AI offerings could generate billions in additional revenue in the coming years. By incorporating AI into its cloud platform, Microsoft is not only expanding its market share in the cloud space but is also positioning itself as an AI powerhouse in the enterprise sector.

- AI Tools and Software Products

Microsoft Office and Dynamics 365 have also been undergoing significant transformation, with AI integration at the heart of these updates. Tools like Microsoft Copilot—an AI-driven assistant embedded across Office 365—are enhancing productivity, streamlining workflow automation, and offering data-driven insights. These upgrades are likely to lead to higher subscription rates and stickiness among customers, translating into long-term revenue growth.

In addition, Microsoft’s recent push to incorporate generative AI into its business software products is likely to yield substantial returns. As businesses seek to leverage AI for everything from predictive analytics to content generation, demand for these AI-powered solutions will rise. The company’s vast enterprise customer base gives it a considerable advantage in monetizing these innovations.

- Gaming and AI in Entertainment

Microsoft is also leveraging AI in its gaming division. Through its acquisition of ZeniMax Media and the integration of AI into gaming experiences, Microsoft is aiming to create more immersive and intelligent game designs. In addition, AI-driven recommendations and content creation are expected to boost engagement on its Xbox and cloud gaming platforms.

AI’s impact on gaming goes beyond content generation—it also improves player experiences through personalized recommendations, better in-game behavior analysis, and optimized game performance. As the gaming industry grows, AI will play a key role in Microsoft’s revenue strategy, driving higher sales and engagement.

The Forward Price-to-Earnings (P/E) Ratio: Is Microsoft Overvalued?

One of the most discussed metrics when evaluating Microsoft’s stock is its P/E ratio. Historically, Microsoft’s P/E ratio has ranged from 20 to 30, but in recent times, it has surged to above 35. This elevated P/E ratio reflects the market’s optimism regarding the company’s future growth prospects, especially in AI. But is this valuation warranted?

To assess whether Microsoft’s P/E ratio is justified, it’s essential to consider the potential growth stemming from its AI investments. Analysts predict that Microsoft’s AI efforts will lead to significant revenue growth, but the pace and sustainability of that growth remain uncertain. Microsoft’s current valuation is based largely on expectations—if these expectations don’t materialize, the stock could face downward pressure.

Moreover, Microsoft’s valuation premium is not solely tied to its AI strategy. The company’s strong market position in cloud computing, enterprise software, and gaming are all contributing factors to its elevated P/E ratio. The challenge for investors is determining whether these other business segments will continue to generate consistent growth, and whether AI will drive enough incremental revenue to justify the current stock price.

Investment Rationale: Is Microsoft a Safe Bet?

From an investment perspective, Microsoft’s stock has several strong attributes. The company boasts a solid track record of revenue growth, excellent profit margins, and strong cash flow generation. Its diversified business model and leadership in cloud computing provide a solid foundation for long-term growth. Furthermore, Microsoft’s AI investments represent an additional layer of growth potential, one that could dramatically accelerate revenue over the next decade.

However, the company’s current valuation presents both opportunities and risks. Investors willing to pay a premium for growth may find value in Microsoft’s AI strategy, especially if the company can continue to expand its AI footprint and turn these investments into significant revenue. But for value-oriented investors, Microsoft’s high P/E ratio and the risks associated with overpaying for growth may be cause for concern.

In terms of AI, the company’s potential to capitalize on its investments in this space is undeniable. However, the technology industry is known for rapid changes, and competitors like Google and Amazon are also aggressively pursuing AI. Microsoft’s ability to stay ahead of these rivals and deliver on its AI promises will be key to maintaining its premium valuation.

The Risks: Over-Hyping AI’s Impact

While Microsoft’s AI push is undoubtedly exciting, there are inherent risks associated with over-hyping the technology’s potential. The market has already priced in a significant impact from AI, and if those returns do not materialize as expected, investors could see a sharp correction in the stock. Additionally, Microsoft faces regulatory risks related to AI, as governments around the world begin to scrutinize the ethics and societal impact of the technology.

AI adoption is also a gradual process. The revenue impact from AI may not be immediately visible, and it could take several years before the full potential of Microsoft’s AI investments is realized. Therefore, investors should be cautious not to overestimate the short-term impact of AI on Microsoft’s bottom line.

Conclusion: Microsoft’s Premium Valuation in 2025

Microsoft’s stock price reflects significant optimism about its AI initiatives, but it also comes with a premium valuation that investors must justify with concrete performance in the years ahead. While the company’s AI investments are promising, there is a risk that the market’s expectations may be too high.

For long-term investors, Microsoft remains an attractive option due to its diverse business segments, solid financial health, and leadership in cloud computing. However, those investing in the stock based on AI’s potential need to carefully consider the risks associated with overestimating the impact of the technology in the short term.

As AI continues to evolve, Microsoft’s ability to stay ahead of the curve and monetize its investments will be the key factor in determining whether its valuation premium is justified or not.