The Return of the Rising Sun

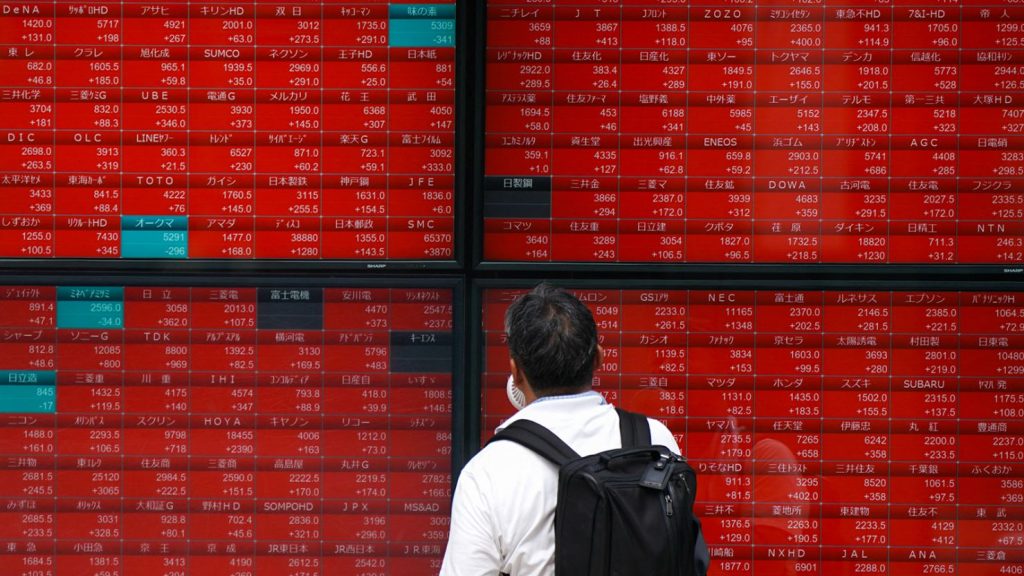

After decades in the shadows of stagnation, Japan’s equity market is once again basking in the limelight. The Nikkei 225 has roared past levels not seen since the asset bubble burst in the early 1990s, thrilling global investors and reviving hopes that the world’s third-largest economy may finally be shaking off its deflationary malaise. Foreign capital has poured in, corporate profits have surged, and Tokyo is back on global investor roadmaps. But beneath the surface of this long-awaited breakout lies a deeper question: is this a cyclical bounce or the start of a secular bull market renaissance?

The answer lies not only in stock charts but in boardrooms, balance sheets, and policy shifts. Japan’s rally isn’t just about market momentum—it’s about structural change, governance reform, and a subtle but powerful evolution in the way Japanese companies are run and how capital is deployed. Yet, skeptics abound. Can a nation long synonymous with demographic decline, deflation, and zombie companies truly rewrite its economic narrative? And just how sticky is this bullish sentiment in a world still ruled by rate cycles, geopolitical tension, and shifting investor tastes?

The Nikkei’s Historic Surge

The Nikkei 225’s climb back above the 40,000 threshold—levels not seen since 1989—is more than just a number. It’s a symbolic reclamation of confidence in the Japanese equity story. Fueled by a perfect storm of favorable factors—yen weakness, strong earnings, shareholder-friendly policies, and global diversification strategies—the index has surged more than 50% from its 2022 lows.

Corporate giants like Toyota, Sony, and Fast Retailing have led the charge, but the rally is broadening to include tech suppliers, banks, and even manufacturing stalwarts that had long been written off as relics of Japan’s past. Foreign investors have returned with renewed interest, lured by Japan’s low valuations, improved ROE, and the desire to hedge against overexposure to U.S. equities and a turbulent China.

Critically, this is not the frothy, speculative surge of the late 1980s. Unlike the bubble era, today’s rally is underpinned by corporate profits, capital discipline, and a much more stable macroeconomic framework. Japan’s inflation, while mild, has finally returned after years of near-zero pricing power. The labor market is tight, consumption is firming, and for the first time in decades, the word “wage growth” is being used without irony.

Structural Reforms Take Root

At the heart of this optimism is a genuine transformation in Japan’s corporate and policy culture. Prime Minister Fumio Kishida’s “New Capitalism” agenda—while light on specifics—has catalyzed momentum for reform. But the real engine is Japan’s own private sector, driven by investor pressure and regulatory nudges.

The Tokyo Stock Exchange has, for the first time, demanded that listed companies with price-to-book ratios below 1x (i.e., trading below their asset value) explain how they will boost capital efficiency. This has triggered a wave of shareholder-friendly initiatives, including stock buybacks, dividend hikes, spin-offs, and cross-shareholding unwinds. The result? Corporate Japan is finally starting to act like it’s listed.

The shift is most visible in the behavior of once-insular conglomerates. Companies like Hitachi have streamlined sprawling empires, Toshiba is breaking apart, and financial institutions are shedding unproductive legacy assets. Meanwhile, activist investors—once unwelcome in Tokyo—now have a seat at the table. Firms like ValueAct and Elliott Management have successfully pushed for governance overhauls, with many more watching closely.

Japanese companies are also embracing global capital discipline. Return on equity (ROE), a long-lagging metric in Japan, is on the rise. In 2024, average ROE for the Topix index surpassed 9%—a dramatic improvement from sub-5% levels seen a decade ago. Cash hoards are being scrutinized, and capital allocation is finally under strategic review.

Demographics and Deflation: Still the Elephants in the Room

Despite the bullish narrative, two persistent headwinds continue to cloud Japan’s long-term outlook: its aging population and its historical battle with deflation. Japan’s demographics are the worst in the G7. The working-age population continues to shrink, and while automation and immigration reform may soften the blow, productivity gains must accelerate to compensate.

On inflation, Japan has only recently exited a 30-year battle with deflationary expectations. Although consumer prices have picked up in recent years—rising 2-3% annually—it’s unclear whether this inflation is sustainable. Much of it has been driven by energy imports and yen weakness, rather than endogenous demand. Moreover, wage inflation remains fragile. The latest “Shunto” spring wage negotiations did show strong results, with major unions securing pay hikes north of 5%, but this must be repeated consistently to break the deflationary mindset.

Still, even these challenges may be more manageable in a reform-minded Japan. Aging populations are now global issues, not just Japanese ones. And structural inflation, once a liability, could now serve as a tailwind in a world accustomed to tightening monetary policy.

The BOJ’s Balancing Act

No discussion of Japan’s bull market is complete without analyzing the role of the Bank of Japan. For years, the BOJ pursued ultra-loose monetary policy, including yield curve control (YCC), in a bid to revive growth and inflation. But in 2024, after decades of easing, the BOJ finally lifted interest rates out of negative territory—an historic move signaling confidence in the durability of inflation and wage trends.

Yet the central bank remains cautious. Rate hikes are expected to be slow and shallow, partly to avoid choking off nascent demand and partly due to Japan’s huge public debt load. This gradualism is seen as positive for equities: real rates remain negative, corporate borrowing costs are low, and asset purchase programs (especially in ETFs) are being unwound gently.

The BOJ’s approach reflects a new strategy—one of monetary normalization without disruption. If successful, this could help anchor Japan’s bull market with long-term credibility. But if the yen continues to weaken significantly or inflation accelerates beyond BOJ forecasts, pressure may mount for a more aggressive stance. For now, markets are giving the BOJ the benefit of the doubt.

Sector Rotation: Tech Still Shines, but Value Makes a Case

One of the more promising signals in Japan’s rally is the breadth of sector participation. While technology names like Tokyo Electron, Advantest, and Renesas remain investor favorites—thanks to AI tailwinds and global chip demand—the rally has broadened to include banks, industrials, and even retail.

Japanese financials, long considered dead money, have benefited from the BOJ’s policy shift. Net interest margins are improving, capital ratios are healthy, and corporate lending is gradually increasing. Mizuho, Sumitomo Mitsui, and other megabanks are outperforming after years of underperformance.

Meanwhile, Japan’s manufacturing base, particularly in precision equipment, robotics, and autos, is regaining investor attention. Companies like Fanuc and Daikin are playing key roles in global supply chains. Even consumer stocks are drawing fresh interest, supported by improving domestic sentiment and inbound tourism, which has rebounded strongly post-pandemic.

The renewed focus on value—after years of growth-driven investing—is also part of the Japan story. Many Japanese stocks still trade at single-digit P/Es with strong balance sheets and global exposure. In a world where U.S. valuations are stretched and China remains risky, Japan’s combination of quality, value, and reform looks increasingly attractive.

Global Capital Flows and Geopolitical Hedging

Another factor supporting Japan’s bull market is its unique position in global geopolitics. As relations between the U.S. and China remain tense, many institutional investors are turning to Japan as a relatively neutral, stable, and sophisticated market in Asia. Tokyo is increasingly seen as a hedge against China risk—particularly in supply chains, intellectual property, and regulatory reliability.

Japan is also benefiting from strategic capital reallocation. Pension funds, sovereign wealth vehicles, and hedge funds have all increased exposure to Japanese equities. The GPIF (Japan’s own government pension fund) has also tilted further toward equities, supporting liquidity and long-term demand. Notably, Warren Buffett’s investments in Japan’s trading houses have served as a powerful signal to global investors: Japan is no longer just a value trap—it’s an opportunity.

So, Is the Bull Here to Stay?

The bullish case for Japan is the strongest it has been in decades. Structural reforms are real. Corporate behavior is changing. Foreign capital is flowing in. Sector participation is broad. Inflation is finally here, and the BOJ is cautiously normalizing policy. From both a top-down and bottom-up perspective, Japan looks compelling.

But the sustainability of this rally will depend on continued execution. Will corporate Japan follow through with reforms? Will wage growth become self-reinforcing? Can inflation remain positive without eroding consumer confidence? And will the BOJ thread the needle of policy normalization without disrupting the fragile equilibrium?

If the answers to these questions trend positive, Japan could finally escape its “lost decades” and enjoy a genuine, lasting bull market. Not just a rebound—but a reinvention.