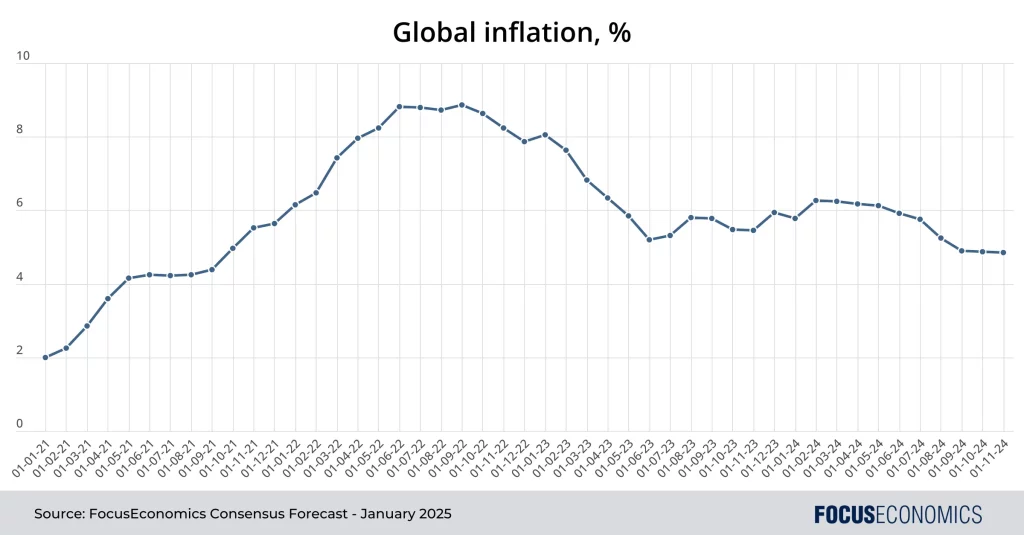

Introduction: Inflation’s Lingering Shadow Over Markets

After a rollercoaster period of surging prices and aggressive interest rate hikes, the world is asking: Is inflation truly under control, or are we just experiencing a temporary reprieve? As of 2025, central banks, investors, and everyday consumers continue to scrutinize inflation metrics like the Consumer Price Index (CPI) and Producer Price Index (PPI) with laser focus. While headline inflation figures suggest significant progress compared to the 2022-2023 highs, experts remain divided on whether inflation risks have been fully extinguished or are merely hibernating. In this article, we examine the latest economic data, explore expert opinions on both short-term and long-term inflation risks, and discuss what it all means for investors and policymakers.

Recent CPI Trends: Cooling But Not Cured

The Consumer Price Index (CPI) is the most widely cited measure of inflation, tracking the average change in prices consumers pay for goods and services. Recent data from Q1 2025 shows the CPI rising at an annual rate of 2.4%, significantly down from the scorching 7%+ rates seen just two years ago. Key contributors to the cooling CPI include lower energy prices, stabilization in food costs, and an easing of supply chain bottlenecks that had previously driven sharp price spikes. However, certain components of the CPI remain “sticky.” Shelter costs, including rents and housing-related expenses, continue to climb, albeit at a slower pace. Additionally, services inflation, covering everything from healthcare to hospitality, remains elevated, highlighting that not all sectors are responding equally to tighter monetary policy. The broad narrative suggests that while inflation is largely under control, complete normalization has yet to be achieved.

Recent PPI Trends: A Mixed Picture from the Supply Side

The Producer Price Index (PPI), which measures inflation from the perspective of producers rather than consumers, offers another lens into price pressures. Recent PPI data indicates a year-over-year rise of 1.9%, suggesting that input costs for businesses are increasing at a manageable pace. Raw materials, particularly in manufacturing and construction, have seen price declines due to easing global demand and improved logistics networks. However, certain areas, such as skilled labor costs and specialized manufacturing components, continue to exert upward pressure. Importantly, the PPI often acts as a leading indicator for future CPI trends, meaning that today’s moderate PPI readings bode well for continued consumer price stability—provided no new shocks emerge.

Expert Commentary: Inflation Risks in the Short Term

Most economists and market analysts agree that short-term inflation risks have diminished considerably compared to the pandemic-era turbulence. Federal Reserve Chair Jerome Powell recently noted that “significant progress” has been made toward restoring price stability, attributing it largely to tighter financial conditions and improved supply dynamics. Investment banks like Goldman Sachs and Morgan Stanley have adjusted their inflation forecasts downward, predicting a range of 2-2.5% CPI growth for the remainder of 2025. However, they caution that certain short-term risks could reignite inflationary pressures. Chief among these risks are geopolitical events, such as renewed energy market disruptions or conflict-driven supply shocks. Additionally, unexpected wage surges in tight labor markets could also reintroduce inflationary momentum. In sum, while immediate inflation threats appear subdued, vigilance remains crucial.

Expert Commentary: Long-Term Inflation Risks Are Harder to Kill

When examining long-term inflation risks, experts strike a more cautious tone. Structural factors suggest that inflation may be more volatile over the coming decade than it was during the ultra-stable pre-pandemic era. One significant long-term risk is the global energy transition. While shifting toward renewable energy is vital, it introduces higher upfront costs and potential supply instability that could keep certain prices elevated. Demographic trends also pose challenges. Aging populations in developed countries could strain healthcare systems and labor markets, leading to persistent service-sector inflation. Meanwhile, deglobalization—the gradual unwinding of highly integrated global supply chains—could structurally elevate production costs. Central banks may find themselves caught between the need to maintain low inflation and the political pressure to support growth and employment. In short, while acute inflationary episodes may be contained for now, the underlying risks of more frequent inflation spikes over the next decade remain very real.

The Role of Monetary Policy: Striking the Right Balance

Central banks, led by the Federal Reserve, have adopted a cautious but increasingly dovish stance in 2025. After aggressively raising rates in 2022-2023, the Fed has begun modest rate cuts, bringing the federal funds rate down to around 4%. These moves aim to support economic growth without reigniting inflation. Critics warn that cutting rates too quickly could repeat the mistakes of the 1970s, when premature easing led to entrenched inflation. Fed officials counter that their actions are data-dependent and will be reversed if inflation reaccelerates. The European Central Bank and Bank of England are following similar paths, indicating a global trend toward cautiously easier monetary conditions. Nevertheless, central bankers remain acutely aware that restoring public trust in their inflation-fighting credentials is paramount, meaning they are unlikely to tolerate significant price instability without swift intervention.

How Investors Are Positioning for Inflation Uncertainty

Faced with a complex inflation landscape, investors are deploying a range of strategies to hedge against potential surprises. Many portfolio managers are increasing allocations to inflation-protected assets, such as Treasury Inflation-Protected Securities (TIPS) and commodities like gold and oil. Real estate investment trusts (REITs) focusing on residential and industrial properties are also in favor, given their historical resilience to inflationary periods. Equity investors are favoring sectors with pricing power, such as healthcare, technology, and consumer staples, which can pass rising costs onto consumers more effectively. Alternative assets, including private credit and infrastructure investments, are gaining popularity as sources of stable, inflation-resistant income. The overarching theme is diversification—not placing all bets on a single inflation outcome but preparing for a range of possible scenarios.

Conclusion: Inflation Is Tamed—But Not Defeated

The battle against inflation has made remarkable progress since its 2022 peak, and the latest CPI and PPI readings provide tangible evidence that price pressures are retreating. However, experts warn against complacency. Short-term risks such as supply shocks and wage pressures, combined with longer-term structural shifts like deglobalization and demographic aging, mean that inflation management will remain a central economic theme for the foreseeable future. Investors, policymakers, and businesses alike must remain agile, vigilant, and ready to adapt strategies as new data emerges. Inflation may no longer be the economic monster of 2022, but its shadow still looms large over financial markets and everyday decision-making in 2025 and beyond.